I am a simple 40+ stay-home-mum born and raised in Singapore, and living in HDB heartland. I have worked as a programmer for 15 years before I decided to quit. Because I am living on my savings now, I try to make my money grow through long-term and short-term investments by chasing dividends.

Friday, 30 August 2013

Dividend Chaser on Benefits of Kiwi

Tuesday, 27 August 2013

Dividend Chaser on boy's eyes gouged out by china trafficker

The child was found covered in blood three to four hours after he went missing while playing outside, according to a television report.

"He had blood all over his face. His eyelids were turned inside out. And inside, his eyeballs were not there," his father told Shanxi Television.

The boy was drugged and "lost consciousness" before the attacker removed his eyes, state broadcaster China Central Television (CCTV) said on its account on Sina Weibo, China's version of Twitter.

It was claimed that the boy's eyes were found nearby but the corneas were missing.

Dividend Chaser on new hdb housing measures

SINGAPORE — With immediate effect, the Housing and Development Board (HDB) has shortened its maximum loan tenure to 25 years and the mortgage servicing ratio (MSR) limit has also been cut to 30 per cent of the borrower’s gross monthly salary.

Previously, HDB loan tenures were at 30 years and the MSR limit was at 35 per cent of the borrower’s gross monthly salary.

From tomorrow (Aug 28), financial institutions will in tandem reduce the maximum tenure of new housing loans and re-financing facilities from 35 years to 30 years.

With immediate effect as well, Permanent Residents (PR) who want to buy resale flats will have to wait three years after receiving their PR status. Prior to this change, they could buy a flat as soon as they received PR status.

Announcing these changes today, the HDB also provided more details of the extension of the Special Housing Grant (SHG) and the new step-up housing grant, which Prime Minster Lee Hsien Loong first announced during the National Day Rally.

The income ceiling for SHG will be raised significantly, from S$2,250 a month to S$6,500 a month for families and S$3,250 for singles. Mr Lee previously announced that the SHG would be extended to middle-income households and could be used for buying new four-room flats.

Under the new step up grant, families who want to upgrade from a two-room to a three-room flat can get a housing grant of S$15,000.

The changes to the housing grants will apply from the last month’s Built-to-order (BTO) exercise.

From next month, parents who want to live near their children will also be offered more alternatives.

Parents will be allowed to apply for three-room flats, under the multi-generation priority scheme (MGPS). Currently, the scheme allows parents to jointly apply, with their married child, for either a studio apartment or two-room flat, together with another flat in the same project. This will come into effect in next month’s BTO exercise.

To further cater to multi-generation families who wish to live under the same roof, the HDB will pilot a new type of flat.

The new Three-Generation flats — 80 of which will be available for sale in Yishun in the BTO exercise next month — will have four bedrooms and three bathrooms, with an internal floor area of about 115 square metres. Subletting of rooms in these new flats will not be allowed for the Minimum Occupation Period to ensure it serves its purpose.

Monday, 26 August 2013

Dividend Chaser on Singtel stake increase in Bharti Telecom

Singapore Telecommunications (Singtel) enters into an agreement with MacRitchie Investments to purchase 788,538 shares or 3.62 percent stake in Indian telecommunications company, Bharti Telecom (Bharti). The purchase will cost Singtel $383.6 million and increase its stake to 39.78 percent from 36.16 percent. Bharti, through its subsidiaries, is the world?s third largest mobile telecommunications company and operates in 20 countries across South Asia, Africa and the Channel Islands. Notably, Bharti owns Bharti Airtel (Airtel), the largest mobile provider in India. This will allow Singtel have an effective interest of 32.34 percent in Airtel.

Dividend Chaser on China Minzhong Big Plunge

China Minzhong called for the halt at 11.15 am on Monday, pending the "release of material announcement".

Its shares opened at S$1.015 each but rapidly plunged to 53 cents, down 48.5 cents or 48 per cent. More than 24 million shares changed hands.

In a 49-page report published this morning, Glaucus alleged that Minzhong fabricated sales to its top two customers, and that its financial performance for its fresh produce segment, with average margins of 66 per cent in the past five years, was too good to be true.

Sunday, 25 August 2013

Dividend Chaser on market sentiment by Daniel Loh

1) QE tapering

The first is of course the well debated QE tapering. It does seem like Wallstreet has accepted that tapering is a fact going to happen this year. The question is by how much. I foresee expectation to be priced into the market by the decision date on the 17th September! I think the extend of the tapering will be the focal point. A minor adjustment might in fact be a catalyst for the market going forward rather than a market panic. And of course, a major adjustment will cause the market to tumble too.

Given Ben Bernanke's way of handling the stock market, I predict that if there is a taper, only a minor adjustment is on the cards this time round. Ben Bernanke is one who knows how to handle market expectations. I think for the first round of tapering, he won't vote for a market panic. A first time trial minor adjustment to let the market adjust to the tapering will be the perfect choice. After the market accepts and adapts, then a bigger 2nd round cut is on the way, and HOPEFULLY after Bernanke leaves. Bernanke then can hold his head high, leaving a legacy name as the FED chairman who brings the stock market from a low to an all time high.

2) 10 year treasury yield

The second talking point is the 10 year treasury yield. Recently, we know that the yield rate is rising. It is rising to a 2 year high and is still climbing. This is causing a panic all across the world. We think that from now on, the yield should be on a long term uptrend. US dollar should be on a long term uptrend. All major currencies should suffer. That is the reason why Asean recently has a currency panic. Ringgit, Thai Baht, Peso and Rupiah are all on a decline against the US dollars. They are especially vulnerable because of the larger account deficit. In fact a lot of the countries in the world are suffering.

The Indian rupee and Aussie dollar have both fallen nearly 15 percent against the US dollar over the past three months, Indonesia's rupiah, the Brazilian real are down 10 percent, the Turkish lira over 5 percent.

The world world is trying to adjust to a stronger US economy, a stronger US dollar and a rising interest rate. Not easy as USD has been weak for years, but I think we will and this currency panic will end.

This process of adjustment needs time as we are accustomed to a weak US dollar and a low US interest rate environment. We do think that this currency panic should be over once traders accept this rising yield fact. It should. There is no need to panic given a good US economy.

Singapore Market

We do think that Singapore has reached a region of supports. 3000-3100 is always the region we hope to accumulate some singapore stocks. We mentioned it on radio recently too. Do not invest all at one go, but a portion of your funds. We expect a strong support at 3000. Anything below that is angbao to us.

However picking stocks in this seemingly lifeless environment is never an easy task. Good technical and fundamental skillsets are needed.

Thursday, 22 August 2013

Dividend Chaser on North Korean Jail camps

Wednesday 21 August 2013

A mother made to kill her own baby. Starving children forced to eat live rats and frogs. Public executions. Torture. Mutilation. These are just a few of the horrific yet routine occurrences in North Korea’s prison camps, according to two former inmates who testified today before a United Nations commission of enquiry in Seoul, South Korea. The Pyongyang regime, by contrast, denies such camps even exist.

The commission, which intends to interview 30 North Korean defectors over five days in a lecture hall at Yonsei University, marks the first time the country’s human rights abuses have been put before an expert UN panel.

Among its first witnesses was 31-year-old Shin Dong-hyuk, who escaped from the gulag in 2005 and recently published a memoir of his experiences. Mr Shin was born and grew up in the infamous Camp 14, and said his earliest memory was of a public execution.

He later informed on his own mother and brother to save himself, and was made to watch their execution, too. He saw a seven-year-old girl beaten to death for stealing a few grains of wheat. When he accidentally dropped a sewing machine, he said: “I thought my whole hand was going to be cut off at the wrist, so I felt thankful and grateful that only my finger was cut off.”

A second defector, 34-year-old Jee Heon-a, said prisoners often resorted to eating salted frogs in an effort to stave off extreme hunger. She also recalled seeing a mother ordered to kill her own baby. A prison guard “told the mother to turn the baby upside down into a bowl of water,” Ms Jee said.

“The mother begged the guard to spare her, but he kept beating her. So the mother, her hands shaking, put the baby face down in the water. The crying stopped and a bubble rose up as it died. A grandmother who had delivered the baby quietly took it out.”

Between 80,000 and 120,000 political prisoners are incarcerated at five vast prison camps in North Korea, according to a 2013 White Paper on the country’s human rights abuses by Seoul’s Korea Institute for National Unification.

“Many inmates end up losing their life,” the paper reported, due to “forced labour, torture, degrading mistreatment, poor nutrition and lack of medical care.”

The country’s young leader, Kim Jong-un, has demonstrated little interest in veering from the aggressive, isolationist foreign policy course of his father, Kim Jong-il. Since taking power in 2011, the younger Mr Kim has ramped up North Korea’s nuclear weapons and rocket programmes, not to mention his own combative rhetoric. Pyongyang also vehemently denies responsibility for any human rights violations, describing such claims as a “political plot” to undermine the regime.

Though the commission is seen by many as being years overdue, it nonetheless comes at an awkward moment, just as relations between North and South Korea appeared to be warming.

On Sunday, Pyongyang announced that it had agreed to hold talks with Seoul over reuniting families who were separated by the Korean War some 60 years ago.

As the UN panel heard its first testimony, the president of the International Committee of the Red Cross, Peter Maurer, arrived in Pyongyang to discuss the resumption of such reunions.

Experts believe the commission is likely to have little concrete effect, and although it is intended partly to publicise the problem, only a few dozen people – many of them journalists – attended the first day’s hearing in Seoul.

The chairman of the commission, Michael Donald Kirby, said that the panel would “seek to determine whether crimes against humanity have occurred,” but that: “It is not possible at this moment to envisage the level of detail that the commission will be able to achieve in establishing lines of responsibility, if any.”

And yet, while people in Seoul seemed largely uninterested in the commission, the news is expected to trickle through to their impoverished neighbours to the north, where campaigners believe it will leave a far deeper impression.

Kim Sang-hun, chairman of South Korea’s Database Centre for North Korean Human Rights, told Reuters: “People here don’t realise how important this is. It will have a tremendously powerful impact across North Korea.”

Tuesday, 20 August 2013

Monday, 19 August 2013

Dividend Chaser on SGX consults public on reduced board lot size

SGX believes the reduced board lot size will benefit the public as individuals will find it easier to invest in higher-priced shares, instead of limiting themselves to lower-priced ones. Many of the index component stocks and blue chips tend to be higher-priced. This will enable retail investors to more easily build balanced and diversified portfolios to grow their savings.

Institutional investors will also be better able to manage their risk exposures through finer asset allocation of funds.

The proposed standard board lot size of 100 units will apply to ordinary shares, real estate investment trusts, business trusts, company warrants, structured warrants, extended settlement contracts and shares on GlobalQuote. Existing board lot sizes of less than 100 units will remain unchanged.

The board lot sizes for exchange traded funds, American Depository Receipts and fixed income instruments, including Singapore Government Securities and preference shares will also remain unchanged.

Thursday, 15 August 2013

Dividend Chaser on Megabug 2013

Wednesday, 14 August 2013

Dividend Chaser on School Term for 2014

SINGAPORE — The Ministry of Education (MOE) today (Aug 15) announced next year’s school terms for primary and secondary schools, as well as junior colleges and the Millennia Institute (MI).

The school year starts on Thursday, Jan 2, and end on Friday, Nov 14.

The MOE said the school year takes into account 40 weeks of curriculum time for teaching and learning before the start of the national examinations, and six weeks of school vacation at end of year for teachers and students.

SCHOOL TERMS

Primary & Secondary

Semester I

Term I: Jan 2–March 14

Term II: March 24–May 30

Semester II

Term III: June 30–Sept 5

Term IV: Sept 15–Nov 14

Junior Colleges, Millennia Institute

Semester I

Term I: Jan 6–March 14; Feb 6–March 14 for JC and MI year 1

Term II: March 24–May 30

Semester II

Term III: June 30–Sept 5

Term IV: Sept 15–Nov 14; Sept 15–end of A level exams for JC year 2, MI year 3

SCHOOL VACATIONS

Primary & Secondary

Between Terms I & II: March 15-March 23

Between Semesters I & II: May 31–June 29

Between Terms III & IV: Sept 6–Sept 14

At End of School Year: Nov 15–Dec 31

Junior Colleges, Millennia Institute

Between Terms I & II: March 15–March 23

Between Semesters I & II: May 31–June 29

Between Terms III & IV: Sept 6–Sept 14

At End of School Year: Nov 15–Dec 31; End of A level exams to Dec 31 for JC year 2, MI year 3

SCHEDULED SCHOOL HOLIDAYS

July 6: Youth Day

July 7 (Mon): scheduled school holiday

Sept 5: Teachers’ Day

Oct 3: Children’s Day (for primary schools and primary sections of full schools only)

PUBLIC HOLIDAYS

Term I

Jan 1: New Year’s Day

Jan 31: Chinese New Year

Feb 1: Chinese New Year

Feb 3 (Mon): scheduled holiday

Term II

April 18: Good Friday

May 1: Labour Day

May 13: Vesak Day

Term III

July 28: Hari Raya Puasa

Aug 9: National Day

Aug 11 (Mon): scheduled holiday

Term IV

Oct 5: Hari Raya Haji

Oct 6 (Mon): scheduled holiday

Oct 23: Deepavali (to be confirmed)

Dec 25: Christmas Day

Friday, 9 August 2013

Dividend Chaser on dangerous driving that kills 4

SINGAPORE — A Singaporean, his Korean girlfriend and both her parents were run over and killed yesterday morning in one of the most horrific accidents on the roads here in recent times.

The driver of the other car involved in the accident has been arrested for dangerous driving causing death, said the police. His licence has also been suspended with immediate effect.

Mr Amron Ayoub, 23, was on his way to the airport with his girlfriend of five years, Ms Jamie Song Jisoo, 24, and her parents and younger brother, when their car’s tyre punctured on the Central Expressway before the Yio Chu Kang exit.

The Song family was on their way to catch a flight back to Korea, it is understood.

After stopping on the road shoulder, they got out of the car to check on the problem when a car ploughed into the young couple and her parents.

Ms Song’s younger brother, also in his 20s, was standing some distance from them and was not hit.

The police said they received a call about the incident at 3.54am.

When they arrived, Ms Song, and her parents, Mr Song Jung Woo and Ms Kim Mee Kyung, were lying motionless on the road. They were pronounced dead at the scene.

Mr Amron was sent to Khoo Teck Puat Hospital, where he succumbed to the multiple injuries he sustained.

The other driver, a 34-year-old man, said he had chest and head pain and was also sent to hospital.

TODAY understands that Ms Song was a polytechnic student, while Mr Amron had just completed his National Service. Her family had come to Singapore to visit her.

The young couple had met at a mutual friend’s party in 2008 and have been travelling with each other’s families regularly.

Ms Song’s older brother is flying over from Korea.

The police are investigating the case.

Dividend Chaser in Tragic accident at Chancery Hill

The two-year-old boy who was hit by a car his Italian grandfather was driving last Thursday is recovering from the accident, his mother told The Straits Times on Tuesday.

The freak accident happened when the boy cycled into the path of the car that his grandfather was reversing into the family's Chancery Hill Walk compound that evening. His grandmother, a woman in her 70s who was visiting from Italy, died trying to protect him from the impact, which severed the boy's leg. The boy's Caucasian mother, still distraught from the accident, declined to say more.

Chinese evening daily Shin Min reported that the deceased grandmother and her husband, also in his 70s, were in Singapore to visit their son, who lives at the Chancery Hill bungalow with his family.

The accident had happened when the grandmother, seeing the two-year-old cycling into the path of the car, yelled at her husband as she ran to try and lift the boy away. But in his panic, her husband mistakenly stepped on the accelerator, which caused the car to hurtle towards his wife and grandson. They were flung 5m into the wall.

Thursday, 8 August 2013

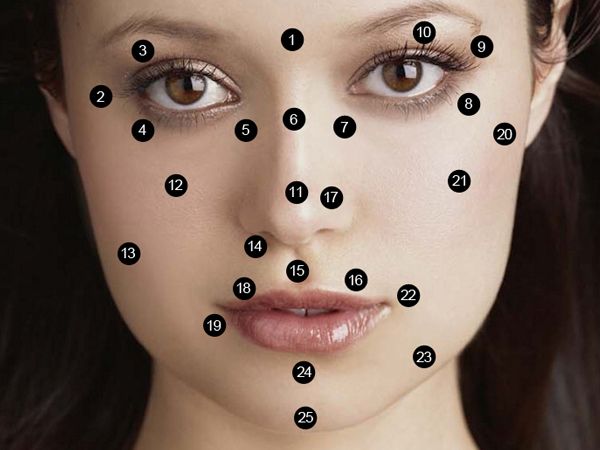

Dividend Chaser on Facial Moles and their meanings

The mole on the side of your lips make you feel like Cindy Crawford. It makes you feel beautiful and sexy but what does it mean according to the the Chinese Almanac, also known as the Tung Shu? Derived by the wise sages and philosophers of ancient China (together with the co-relation of codes, symbols and astrology) the secrets from the almanac regarding facial moles are revealed.

Position 1 to 3: Rebellious, a free spirit, an innate creativity and you have an avante garde approach to life. Be your own boss rather than working for somebody as you basically cannot get along with parents, boss or the elderly. So do keep a distance.

Position 4: An impulsive person who is charismatic with a sparkling personality, you tend to be argumentative and have a temper. This mole seem to indicate that you will have an unstable life. You need to learn how to plan your life and career.

Position 5: (above the eyebrow) – May encounter misfortune brought on by family or friends, or may have bad luck with money. If you have a mole here, it is advisable not to be too trusting of others. Follow your instincts and be cautious. And never allow other people to control your finances.

A mole above the eyebrow indicates that there is wealth luck in your life, but you will need to earn it and work harder than most people

Position 6: (in the eyebrow) – Very smart, creative or artistic. Will have wealth and fame, and have good luck with money. A mole here indicates intelligence, creativity and skill as an artist. Your artistic talent can bring you wealth, fame and success.

You are not a person to be trifled with for you are no pushover and do not forgive and forget easily. This mole is a mark of someone who will go down in history either as a great or as a tyrant.

Position 21: Tend to have foot problems. Need to prevent water-related accidents. This is a good mole, as it suggests plenty to eat and drink throughout your life. This mole also brings fame and recognition.

Wednesday, 7 August 2013

Dividend Chaser on Soilbuild reits IPO

SINGAPORE — Singapore developer Soilbuild Group Holdings launched yesterday a S$457.5 million initial public offering of its business space assets, pricing its units at S$0.78 apiece, the lower end of its indicative range.

The IPO comes two weeks after two real estate investment trusts had somewhat mixed fortunes on their debut, with SPH REIT gaining 9 per cent but OUE Hospitality Trust ending flat.

Soilbuild Business Space REIT (Soilbuild REIT), which owns two business parks and five industrial properties, is offering 586.5 million units. The placement tranche comprises 524 million units and the public offer 62.5 million units. Soilbuild had previously set an indicative price range of S$0.77 to S$0.80 per unit.

At S$0.78, the REIT offers a dividend yield of 7.7 per cent based on projections for fiscal 2014.

Soilbuild and founder Lim Chap Huat will hold an interest of about 27 per cent in the REIT post-IPO, the company said.

According to DTZ Debenham Tie Leung (SEA), the REIT offers the largest exposure to the business park segment compared with other Singapore-listed REITs. It has the highest proportion of business park assets — 42.5 per cent by purchase price compared with 8 per cent to 21 per cent for other listed Singapore industrial REITs.

The IPO portfolio is valued at S$935 million, with an aggregate gross floor area of more than 3.2 million sq ft as of end-June.

The IPO closes on Aug 14, with listing scheduled for Aug 16.

Citigroup, DBS Group and Oversea-Chinese Banking Corp are managing the offering. With Agencies

Tuesday, 6 August 2013

Dividend Chaser on Global Premium Hotel Results

Tuesday, 6 August 2013

Global Premium Hotels

OCBC on 5 Aug 2013The 2Q13 results for Global Premium Hotels (GPH) were generally in line with our expectations. Revenue climbed 1.0% YoY to S$15.4m and gross profit rose 1.1% to S$13.4m. Administrative expense fell 19.4% YoY to S$5.5m mainly due to one-off recognition of IPO expenses of S$1.4m in 2Q12. Interest expense was 9.8% higher at S$1.9m due to the restructuring exercise undertaken by GPH pursuant to the IPO in 2Q12. 2Q13 net profit climbed 36.2% to S$4.9m. 1H13 revenue and net profit came to 48% and 51% of our prior respective full-year estimates, which we are adjusting slightly.

Higher occupancy drove RevPAR growth

2Q13 hotel room revenue increased 1.3% YoY to S$15.1m. RevPAR was 2% higher at S$95.7, chiefly due to higher average occupancy rate of 93.1%, up 3.4 ppt. GPH's operational performance figures were stronger than its peer group's. RevPAR for Singapore hotels in the Economy and Mid-tier categories saw RevPAR in each month of 2Q13 fall by low to high single-digit percentages. GPH's rental income for 2Q13 dropped by 13.4% YoY to S$246k due to the disposals of the Changi Road property and Pasir Panjang commercial property in 2Q12.

Expect 2H13 to be stronger than 1H13

We expect 2H13 to be slightly better than 1H13 because we understand from industry sources that the sector as a whole has seen some stabilisation in 3Q13. Management continues to believe that with the increasing prevalence of budget airlines in the region, the performance of GPH's economy-tier and mid-tier hotels will continue to be resilient, despite increasing hotel room supply for the industry.

Maintain BUY

Using a 10% discount to RNAV, we maintain our fair value of S$0.33 and BUY rating on GPH.

Monday, 5 August 2013

Dividend Chaser on Not getting into primary school of choice

My Son Can't Get Into My School of First Choice!

Many parents have been panicking recently and indulge into self-blame: Why haven’t I volunteered so my child can get into the best primary school? There are so many primary schools; which is the best? Will my kid’s future be affected because he didn’t get to his choice school?

As a practical and kiasu person, I will tell you that you are fretting over nothing. I think all primary schools here are great in Singapore and we can worry about the “branding” of the school later, when your child is in his secondary school years and beyond.

Here are four reasons why you should take a chill pill.

1. All Singapore primary schools are great

I cannot claim I am the expert in this but I did relief teach in several schools over the past decade, tutored children from different schools and have friends who are primary school teachers. I have seen the teaching materials, the dedication of the teachers and I grew up as part of the Singapore education system. Our school system is ranked fifth in the whole world last year, according to a report by the Pearson Group. Even the worst in Singapore can't be all that bad, right?

With the social media, kiasu parents and stiff competition these days, I think all teachers and schools in Singapore are striving to be the best.

2. Personal experience

I was from Yishun Primary School, a neighbourhood school.

Back in the 1980s, parents didn’t care as much but I think my mates and I turned out alright. I did well enough for my PSLE to go to the Chinese High (now called Hwachong Institution.) Some of my classmates went to Raffles Institution, St Nicholas Girls’ and moved on to have great careers in life. There was even a classmate who became a president's scholar.

3. Parents Matter Most

Most importantly, in the primary school years, parents are the most important. You influence your child the most in his childhood.

You are the person the child depends on his whole life- he listens to you more than anyone else. Your values are his values. We have seen how musicians breed children who become musicians because of the nurturing from young. Look at Frank Sinatra and Nancy Sinatra or Nat King Cole and Natalie Cole. In politics, we have George Bush and George Bush Jr who are both U.S. presidents.

According to Dancy Hango, a researcher at the London School of Economics and Political Science, parental involvement in their children's lives can have a "lasting impact" on well-being. The investment in the child's potential human capital through relationships, or social capital, is crucial for educational success, said James Coleman in his report in the American Journal of Sociology in 1977. Regardless which school your child is enrolled in, without your valuable input, he may not achieve as much.

And during the Primary school years, most of the time, we will be able to coach our children in their school work.

4. It's only primary school

If this were high school, I would agree the choice of school is crucial because the child is entering puberty. That's when there's a strong desire for autonomy and distance from the family. You wouldn't be able to influence him even if you wanted to.

And perhaps, we would have forgotten our secondary school chemistry and wouldn’t be able to coach him as well.

If this is a choice between going to Harvard or some unknown community college in the suburbs, yes, one needs to be make a wise decision. But always put things in perspective- this is JUST primary school. The child can manage if he goes to a less well-known school. And when he grows up, no matter how fussy the organization is, nobody will ask which primary school he is from when applying for jobs. Trust me.

What you could do instead

I spoke to a lot of parents recently and they complained how their children are not enjoying their childhood and they would prefer their child to have fun and “not become a cyborg,” as one father put it.

Then start making the change. It begins from you.

In the children's most impressionable years, it’s the parents’ onus to impart the values they deem to be most important to their kids. Studies are important indeed, especially in Singapore. But you are the best person, not the school, who knows what your child’s talents are. A good school can complement your child’s growth but the parent’s role can never be substituted.

My father talked to me about current affairs when I was a kid and encouraged me to submit essays to the papers. I had a whole file of my compositions printed on the local papers by the time I was 12. He realized my passion for broadcasting and bought me a radio when I was 10: I would always be so grateful to him for that.

I was a radio DJ for a few years, while I was studying for my degree. I moved on to be a journalist at international organizations. And I may not have pursued my passion for writing if my dad hadn’t encouraged me when I was young.

To be sure, it’s definitely assuring to have great, caring teachers and the “best” school for your child. The years between six and 14 are a time of important development advances that establish children's sense of identity, according to Jacquelynne S. Eccles, a professor of education the University of Michigan.

But the truth is only you can be the best mentor for him. Great if your child got into the school of his choice, but if he didn’t, it’s not the end of the world.

Because your child still has you--- his greatest asset. So relax now, enjoy your time with your kid, while he still doesn't mind hanging out with you. ;)